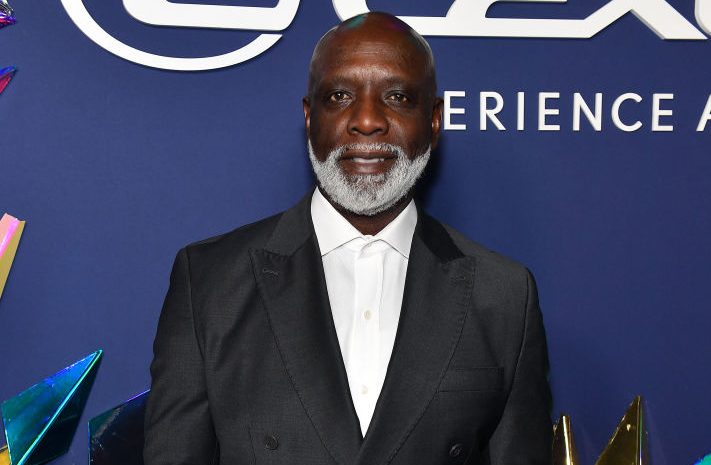

Source: Paras Griffin / Getty

Peter Thomas, known for his time on Real Housewives of Atlanta, recently took to social media to publicly address a major issue—he admitted to neglecting his business taxes for approximately ten years.

Text “RICKEY” to 71007 to join the Rickey Smiley Morning Show mobile club for exclusive news. (Terms and conditions).

In a candid video shared on Monday, June 24, Thomas began by extending apologies to his family, especially his late father, along with his friends. He stated, “I’ve did some wrong that I have to make right. I have to stand up, I have to be accountable, I have to be responsible and I have to pay my debt.”

LIKE US ON FACEBOOK. FOLLOW US ON TWITTER AND INSTAGRAM. SUBSCRIBE TO OUR YOUTUBE.

CLICK HERE TO DOWNLOAD OUR APP AND TAKE US WITH YOU ANYWHERE!

Acknowledging the ongoing IRS case against him since early 2022, Thomas openly admitted to failing to pay withholding taxes for his struggling businesses. He shared, “From one struggling business to the next … I failed to pay my withholding taxes on time. And at some point, when the business wasn’t doing well, failed to pay at all. It’s something that I thought I could work out, catch up with, make whole. But then the hole got deeper for me.”

Love The Rickey Smiley Morning Show? Get more! Join the The Rickey Smiley Morning Show Newsletter

We care about your data. See our privacy policy.

Thomas, who also recently faced a substantial $9 million judgment for unpaid rent at his Miami restaurant, expressed deep remorse for not prioritizing IRS withholding taxes in his financial responsibilities. He emphasized, “I deeply regret, deeply, and I’m saying this with all sincerity, I deeply regret [not making] the IRS withholding taxes a priority in my life. With no excuses because there is none. It’s the law. And I’m finding out a lot about that law lately.”

Related Article: Peter Thomas Reacts To $9M Default Judgment For Unpaid Miami Restaurant Rent: ‘They’ll Never See A Dime’

Furthermore, Thomas shared a cautionary message for fellow business owners, advising them to ensure they have sufficient funds to cover employee payments and prioritize tax obligations. He emphasized, “Make sure you can cover those withholding taxes. Make sure on the 20th of every month you pay those revenue taxes. When those things add up, Uncle Sam is your partner. They’re not getting their piece, it keeps on adding up, it’s gonna come and it’s gonna bite you.”

HEAD BACK TO THE RICKEYSMILEYMORNINGSHOW.COM HOMEPAGE